Tax Planning

We all have to pay taxes, but they can significantly reduce returns on investments, which can impact your portfolio. Savvy tax-planning strategies can be a major component of your financial plan, potentially giving you extra cash to meet your needs and wants. To encourage Canadians to save more, the government created several tax-favoured savings alternatives. Tax-deferred investment accounts include Registered Retirement Savings Plans (RRSPs), company-sponsored pension plans, Individual Pension Plans (IPPs) and Tax-Free Savings Accounts (TFSAs). Investing on a tax-deferred basis means paying taxes later rather than sooner. Any appreciation or interest earned on these investments grows without being taxed. Of course, funds generally become taxable upon withdrawal (except in the case of TFSAs, from which withdrawals are tax-free). While most investments are ultimately taxable, deferring taxes can potentially result in substantial gains over time. Taxes on income, such as dividends or interest must be paid annually in non-registered plans.

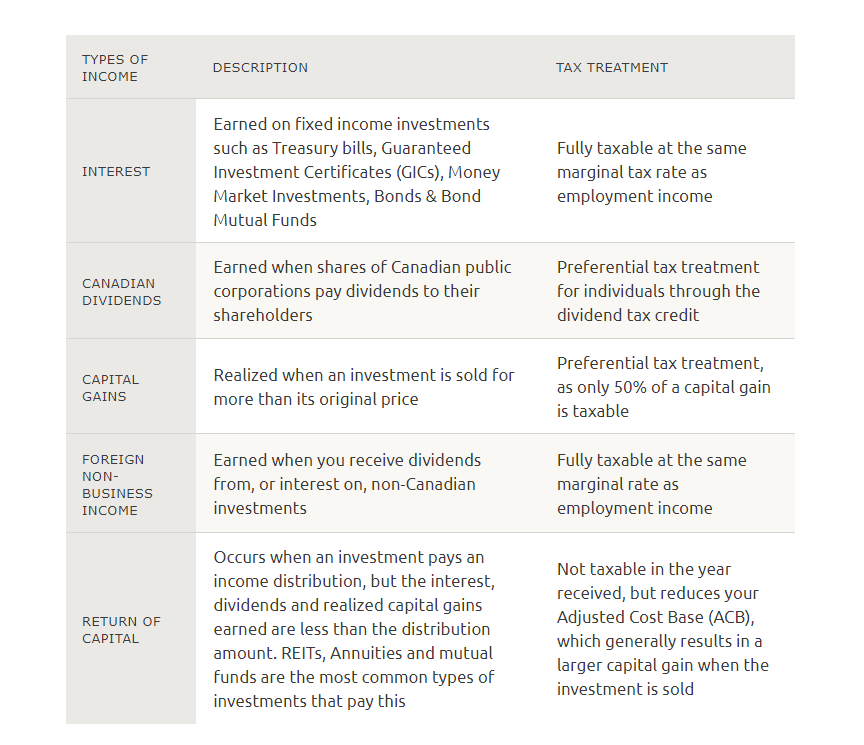

We can help you understand the tax implications of various investment options so you can take advantage of the most tax effective ways to meet your objectives. Not all investment income is taxed equally, and as a result, where you hold your investments matters too. Here are some of the most common types of investment income:

Using tax effective strategies when choosing your investments may help you reduce or defer the amount of tax incurred. Please contact us to schedule a confidential meeting to discuss your investment management.

While we are familiar with the tax provisions of the issues presented herein, as financial advisors of Raymond James, we are not qualified to render advice on tax or legal matters. You should discuss tax or legal matters with the appropriate professional.

- Victoria 1175 Douglas St Ste 1000 Victoria, BC V8W 2E1

- T 250.405.2429

- Map & Directions

- Map & Directions

- Stony Plain 4310 33 Street Suite #118 Stony Plain, AB

- T 780.399.5552

- Map & Directions

- Map & Directions

- Edmonton 2300-10060 Jasper Avenue Edmonton, AB T5J 3R8

- T 780.399.5552

- Map & Directions

- Map & Directions

© 2026 Raymond James Ltd. All rights reserved.

Privacy | Advisor Website Disclaimers | Manage Cookie Preferences

Raymond James Ltd. is an indirect wholly-owned subsidiary of Raymond James Financial, Inc., regulated by the Canadian Investment Regulatory Organization (CIRO) and is a member of the Canadian Investor Protection Fund.

Securities-related products and services are offered through Raymond James Ltd.

Insurance products and services are offered through Raymond James Financial Planning Ltd, which is not a member of the Canadian Investor Protection Fund.

Raymond James Ltd.’s trust services are offered by Solus Trust Company (“STC”). STC is an affiliate of Raymond James Ltd. and offers trust services across Canada. STC is not regulated by CIRO and is not a Member of the Canadian Investor Protection Fund.

Raymond James advisors are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. Statistics and factual data and other information are from sources RJL believes to be reliable, but their accuracy cannot be guaranteed.

Use of the Raymond James Ltd. website is governed by the Web Use Agreement | Client Concerns.

Raymond James (USA) Ltd., member FINRA/SIPC. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions in which they are properly registered. | RJLU Legal

Please click on the link below to stay connected via email.

*You can withdraw your consent at any time by unsubscribing to our emails.

© 2025 Raymond James Ltd. All rights reserved. Member IIROC / CIPF | Privacy Policy | Web Use Agreement